I recently had the pleasure of hanging out with my girlfriends from high school. Having known each other for more than 20 years, it’s awesome to reminisce about the old days. One of the things we talked about was how I’ve always stressed about money. I told them I’m like this because growing up low income made me constantly worried about money and becoming homeless. My friends had no idea my family was struggling and told me about their own families’ struggles. It turns out all three of us came from low income households. We each couldn’t believe that the others had similar experiences.

That discussion made me think a lot about how challenging having a low income can be. When I was a kid seeing my mom struggle to cover the bills, I often wondered what the bills were and how much everything cost. I think it’s important for parents to teach kids about their household expenses so they don’t feel in the dark about what it takes to keep a roof over their heads. I think it’s important to teach children the importance of a budget. Budgeting is a tough skill, it requires discipline and knowledge of how you should allocate your funds.

When you have a low income like I did growing up budgeting can be even harder especially when it feels like there isn’t enough money to cover the most essential expenses. Most Canadians find it hard to keep track of their money goes each month. Without an accurate way to track expenses across accounts it’s difficult to see where your money is going. If you can’t see where your money is going it makes it harder to allocate enough for expenses without overspending. And if you can’t set aside money for expenses you won’t be able to set aside money for savings and investments.

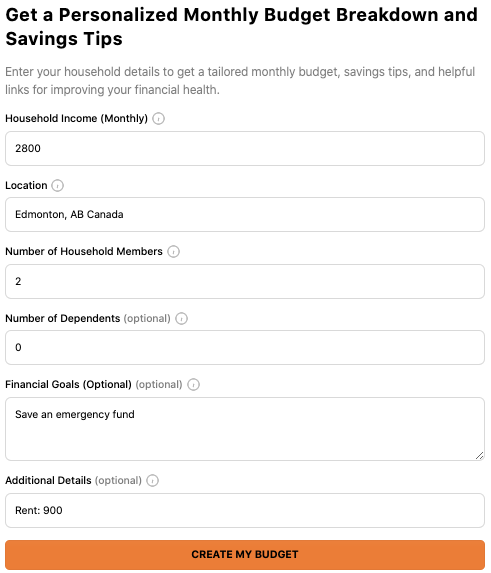

If you’ve ever wondered whether you’re budgeting right for your location, family size, or personal goals, you’re not alone. That’s why I’ve developed a budget creator tool that you can use to create a budget based on your personal goals. This budget tool uses AI to make an itemized budget tailored to your situation. You can enter your income, location, number of dependents, number of household members, and financial goals, and you’ll get monthly budget breakdown, savings tips, and resources to help you learn more.

Why Use My AI Budget Optimizer?

- Location-Specific Guidance: Results are designed for your area and city.

- Personalized for Your Household: Adjusts for your unique household size, income, and goals.

- Clarifies How Much of Income to Allocate: Understand how much to spend and why.

- Actionable Savings Tips: Get practical advice.

- Next Steps: Get links to guides and videos for your to learn more.

- Free & Private: No sign-up required. Your information is never stored.

*Remember to factor in the income tax rates for your area.

Sample Budget

The example below shows a budget based on a $40,000/year salary ($20/hr) after taxes in Edmonton, Alberta Canada.

1. Customized Monthly Budget Breakdown

| Category | Amount (CAD) | % of Net Income | Why This Allocation? |

|---|---|---|---|

| Housing (Rent) | $900 | 32% | Recommended under 35% to keep housing affordable and stress-free. Your rent fits well here. |

| Utilities | $150 | 5% | Covers electricity, water, heating—essential but manageable expenses in Edmonton’s climate. |

| Food | $420 | 15% | Balanced budget for groceries and occasional dining out, prioritizing healthy, cost-effective meals. |

| Transportation | $210 | 7.5% | Includes public transit or gas; Edmonton’s transit is affordable and practical for commuting. |

| Insurance | $140 | 5% | Health, tenant, or car insurance to protect your household without overpaying. |

| Savings (Emergency Fund) | $420 | 15% | Building an emergency fund is vital; 15% helps you save steadily towards 3-6 months of expenses. |

| Discretionary | $350 | 12.5% | Includes entertainment, phone, clothing, and small luxuries to maintain quality of life. |

| Miscellaneous/Buffer | $210 | 7.5% | For unexpected expenses or minor financial fluctuations in bills or income. |

Total Net Income Used: $2,800

Net Income Estimate: Based on $2,800 take-home pay (after taxes).

- Savings Tips

- Shop Smart and Meal Plan: Plan meals weekly using sales and coupons from Edmonton grocery stores (like Safeway or No Frills) to reduce food spending without sacrificing nutrition.

- Use Edmonton Transit: Opt for monthly transit passes instead of driving when possible to save on gas, parking, and car maintenance.

- Automate Savings: Set up automatic transfers to your savings account right after each paycheck arrives to build your emergency fund painlessly.

- Recommended Resources

- Government of Canada – Budgeting Basics — A practical guide to managing money and building an emergency fund.

- Edmonton Transit System Guide — Details on affordable transit options helping reduce transportation costs.

This budget and advice aim to keep your finances healthy while saving toward your emergency fund in Edmonton’s cost environment.

You can use these budgets as a guide to give you a relative idea of how you should be allocating your funds and adjust according to your situation. You can also put specific details into the additional details field to add specific expenses you need to cover. Where you find that your current spending are over the recommended allocation that’s an indicator that you may be overspending in an area. Think about how you can reduce that expense so you can free up those funds to allocate to other areas.

Budgeting can be tough, but with a blueprint it can make it easier to give every dollar you have a job so you can achieve your financial goals. Try out this budget creator tool. If there’s something you’d like to see, share your feedback and I’ll make changes to accommodate your needs.

Leave a Reply